Paid in Cash $450,000 to Buy Back 30,000 Shares From the Market

What is the Earnings per Share (EPS) Formula?

EPS is a financial ratio Financial Ratios Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company , which divides net earnings Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through available to common shareholders by the averageoutstanding shares Weighted Average Shares Outstanding Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) on a company's financial statements over a certain period of time. The EPS formula indicates a company's ability to produce net profits for common shareholders. This guide breaks down the Earnings per Share formula in detail.

A single EPS value for one company is somewhat arbitrary. The number is more valuable when analyzed against other companies in the industry, and when compared to the company's share price (the P/E Ratio Price Earnings Ratio The Price Earnings Ratio (P/E Ratio is the relationship between a company's stock price and earnings per share. It provides a better sense of the value of a company. ). Between two companies in the same industry with the same number of shares outstanding, higher EPS indicates better profitability. EPS is typically used in conjunction with a company's share price to determine whether it is relatively "cheap" (low P/E ratio) or "expensive" (high P/E ratio).

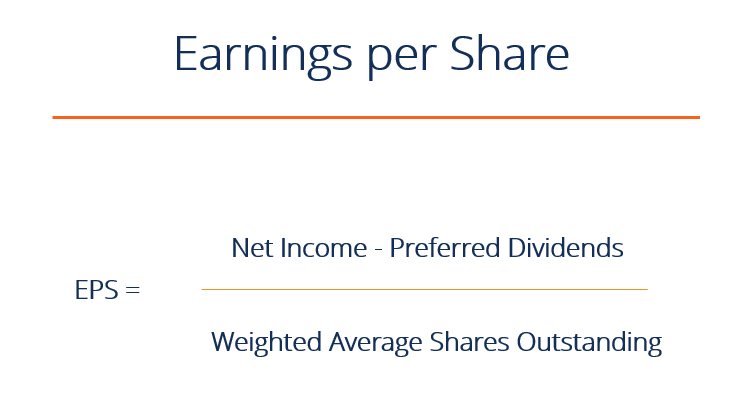

Earnings per Share Formula

There are several ways to calculate earnings per share.

Below are two versions of the earnings per share formula:

EPS = (Net Income – Preferred Dividends) / End of period Shares Outstanding

EPS = (Net Income – Preferred Dividends) / Weighted Average Shares Outstanding

The first formula uses total outstanding shares to calculate EPS, but in practice, analysts may use the weighted average shares outstanding Weighted Average Shares Outstanding Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period. The number of weighted average shares outstanding is used in calculating metrics such as Earnings per Share (EPS) on a company's financial statements when calculating the denominator. Since outstanding shares can change over time, analysts often use last period shares outstanding.

There is also often talk of diluted EPS in financial reports. Diluted EPS Valuation Free valuation guides to learn the most important concepts at your own pace. These articles will teach you business valuation best practices and how to value a company using comparable company analysis, discounted cash flow (DCF) modeling, and precedent transactions, as used in investment banking, equity research, includes options, convertible securities, and warrants outstanding that can affect total shares outstanding when exercised.

Another type of earnings per share formula is adjusted EPS Normalized EPS Normalized EPS refers to adjustments made to the income statement to reflect the up and down cycles of the economy. . This removes all non-core profits and losses, as well as those in minority interests. The focus of this calculation is to see only profit Profit Profit is the value remaining after a company's expenses have been paid. It can be found on an income statement. If the value that remains or loss generated from core operations on a normalized basis.

Earnings Per Share Formula Example

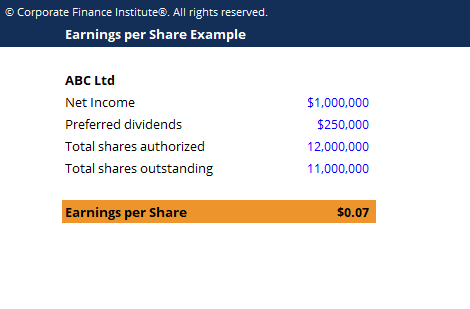

ABC Ltd has a net income of $1 million in the third quarter. The company announces dividends of $250,000. Total shares outstanding is at 11,000,000.

The EPS of ABC Ltd. would be:

EPS = ($1,000,000 – $250,000) / 11,000,000

EPS = $0.068

Since every share receives an equal slice of the pie of net income, they would each receive $0.068.

Earnings per Share Formula Template

Download CFI's free earnings per share formula template to fill in your own numbers and calculate the EPS formula on your own.

As you can see in the Excel screenshot below, if ABC Ltd has a net income of $1 million, dividends of $0.25 million, and shares outstanding of 11 million, the earnings per share formula is ($1 – $0.25) / 11 = $0.07.

Note that many companies do not have preferred shares, and for those companies, there are no preferred dividends that need to be deducted. The reason preferred dividends are deducted is that EPS represents only the earnings available to common shareholders, and preferred dividends need to be paid out before common shareholders receive anything.

Download the Free Template

Enter your name and email in the form below and download the free template now!

EPS Example Template

Download the free Excel template now to advance your finance knowledge!

Video Explanation of Earnings Per Share Formula (EPS)

Watch this short video to quickly understand the main concepts covered in this guide, including what Earnings Per Share is, the formula for EPS, and an example of EPS calculation.

Price to Earnings Ratio

Earnings per share are almost always analyzed relative to a company's share price. This ratio is known as the Price to Earnings Ratio (or P/E ratio). Learn more in CFI's guide to the Price-Earnings Ratio Price Earnings Ratio The Price Earnings Ratio (P/E Ratio is the relationship between a company's stock price and earnings per share. It provides a better sense of the value of a company. .

Additional Resources

This has been CFI's guide to the earnings per share formula. To learn more about other forms of financial analysis and to advance your career as a certified financial analyst Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! , explore the additional CFI resources below:

- Cash EPS Cash Earnings Per Share Cash earnings per share (cash EPS) is the operating cash flow generated by a company divided by the number of shares outstanding. Cash earnings per share (Cash EPS) is different from traditional earnings per share (EPS), which takes the company's net income and divides it by the number of shares outstanding.

- Price-Earnings Ratio Price Earnings Ratio The Price Earnings Ratio (P/E Ratio is the relationship between a company's stock price and earnings per share. It provides a better sense of the value of a company.

- Analysis of Financial Statements Analysis of Financial Statements How to perform Analysis of Financial Statements. This guide will teach you to perform financial statement analysis of the income statement,

- Financial Modeling Guide Free Financial Modeling Guide This financial modeling guide covers Excel tips and best practices on assumptions, drivers, forecasting, linking the three statements, DCF analysis, more

Paid in Cash $450,000 to Buy Back 30,000 Shares From the Market

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/earnings-per-share-eps-formula/

0 Response to "Paid in Cash $450,000 to Buy Back 30,000 Shares From the Market"

Post a Comment